Menu

Close

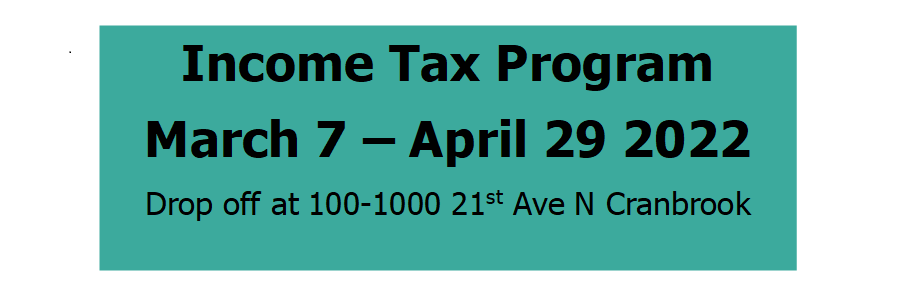

Income Tax Program March 7 to April 29 2022

May 12, 2022

CMHA Kootenays Volunteer Income Tax Program Drop off will commence March 7 2022 to April 29 2022 for the 2021 Tax Year.

Volunteers can complete your income tax if ALL of the following apply:

- you are unable to complete your income tax return alone and

- you earn less than $35,000 / year for a single or $45,0000/ year for married / common-law couples OR single parent with children and

- have a simple tax situation; and

- must file a return to receive GST Credit, Child Tax Benefit, or Climate Action Tax Credit.

Volunteers are unable to assist if:

- you earn more than $35,000 / year for a single or $45,0000/ year (for married / common-law couples OR single parent with children) or

- you are self-employed or

- are doing returns for deceased persons or

- are filing for or in bankruptcy or

- have capital gains or losses or

- report employment expenses or business / rental income expenses.

We encourage you to complete the Client Information Sheets , including the 3 highlighted signature areas, prior to dropping your documents off at 100 – 1000 21st Ave N Cranbrook, BC to limit the amount of time you spend in the office.

Or you can scan, password protect (2022VITP2021) and email all documents, including the completed Client Information Sheets to incometax@cmhakootenays.org

Only 1 person / household is allowed in the lobby area at a time, so if you see someone inside, please wait outside.

We will contact you once your income tax returns have been filed and you can come pick up your documents.